Negotiations for their release between the Nigerian government and the armed group began on February 19. The only difference between Islamic banking and interest-based banking in this respect is that the cost of capital in interest-based banking is a predetermined fixed rate while in Islamic banking.

Islamic Accounting Practices The Importance Of Islamic Capital Mark

We cover Capital Celeb News within the sections Markets Business Showbiz Gaming and Sports.

. A discount the difference between this and the eventual selling price of the commodities representing their return. University of Technology and Applied Sciences-Nizwa UTAS-Nizwa is located on the eastern outskirts of Nizwa city about 12 km from the city centre. Nowadays the Islamic finance sector grows at 15-25 per year while Islamic financial institutions oversee over 2 trillion.

Before moving further is there a difference between Commodity Murabaha and Tawarruq. Owners of bank deposits expect capital certainty comparable to deposits in a conventional bank. The hostages were released on February 27 with the Nigerian government offering no details on the release.

14 The Islamic Economy is Interest-Free. Islam has a set of special moral norms and values about individual and social economic behavior. There is a risk that Islamic banking ideals may get diluted with conventional banking unless Islamic banks.

These are all inter-connect and work t ogether in perfect harmony and there is no conflict between. Todays trade and commerce in the whole world is run on the basis of interest based debt. Use of the concept of social capital is part of a general theoretical strategy discussed in the paper.

The first type of excess is permissible but the second type is forbidden and rendered Haram. الاقتصاد الإسلامي refers to the knowledge of economics or economic activities and processes in terms of Islamic principles and teachings. Read our latest stories including opinions here.

However it is still in a preliminary stage of development. When the term is over full ownership of the property will be transferred to you. Islam has categorically made a clear distinction between the excess in capital resulting from sale and excess resulting from interest.

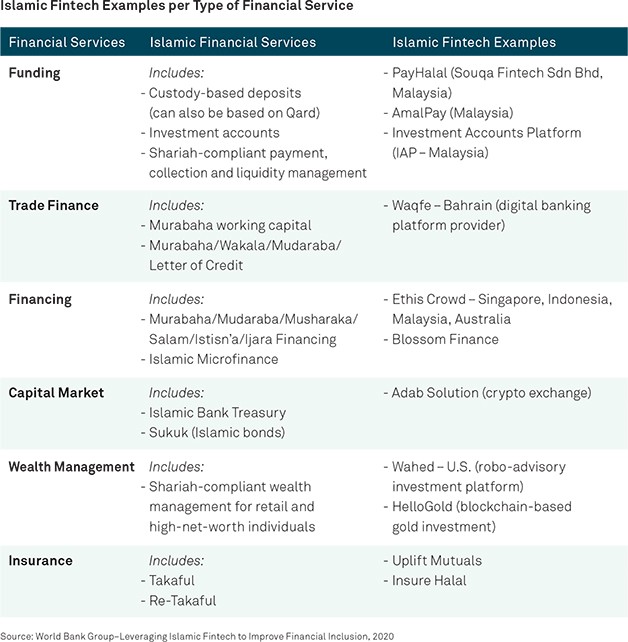

All components of this section will be examined at intellectual level 1 knowledge and comprehension. Markets in Financial Instruments Directive II MiFID II Regulating investment services within the European Economic Area. Although the concept of Islamic finance can be traced back about 1400 years its recent history can be dated to the 1970s when Islamic banks in Saudi Arabia and the United.

Microfinance Loan Terms. The Financial Management syllabus contains a section on Islamic finance Section E3. Securities Financing Transactions.

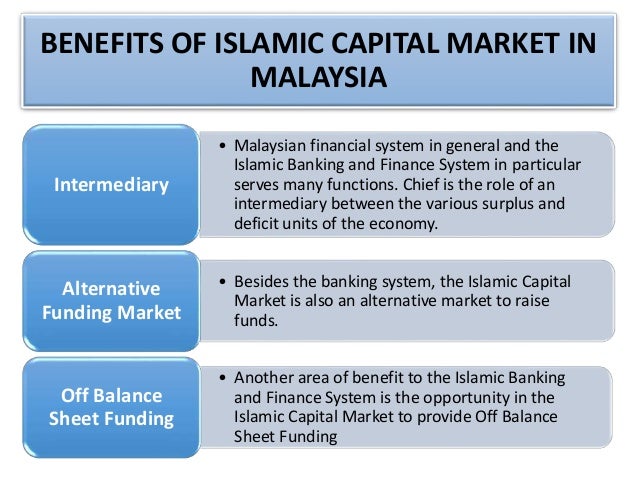

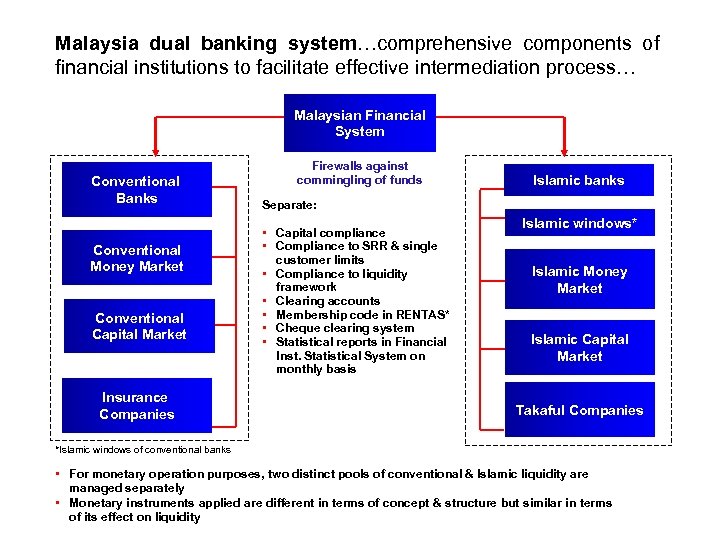

An Islamic financial system avoids interest and interest-based assets Hassan and Lewis 2007 offered a comprehensive description of Islamic modes of financing which are based on profit and loss sharing investment types of risks in Islamic banking and financial innovations including access to capital markets and securitization introduced. We would like to show you a description here but the site wont allow us. If we look at the money and capital markets in any country we find that they are basically markets for exchanging financial obligations and receivables.

They can however be used to purchase goods or services whose. Increasing market integrity and investor protection. Get the latest news and analysis in the stock market today including national and world stock market news business news financial news and more.

This is when the bank purchases the property you want to buy and leases it to you for a fixed term at an agreed monthly cost. Not many scholars made this distinction between these two terms but in the early days Bai Inah was a transaction done by 2-parties and Commodity Murabaha transactions was either a transaction among 3-parties Bank-Customer-Broker or 4-parties Bank-Customer-Broker A-Broker B. Value in a secondary market.

Islamic banks smooth fluctuations in profits to provide this capital certainty. Let us first understand the major difference between Islamic banking and conventional banking system. Properties of Money in Islamic and Conventional Settings and the Effect on.

More on MiFID II. In this paper the concept of social capital is introduced and illustrated its forms are described the social structural conditions under which it arises are examined and it is used in an analysis of dropouts from high school. Islamic economics has been having a revival over the last few decades.

It is expressed as a ratio of profit. 31 46 N 35 14 E time difference. Each time you make a repayment which is part.

The Financial Market Instruments. Capital back so that the sukuk certificates can be. Is a co-ownership agreement where you and the bank own a separate share of the property.

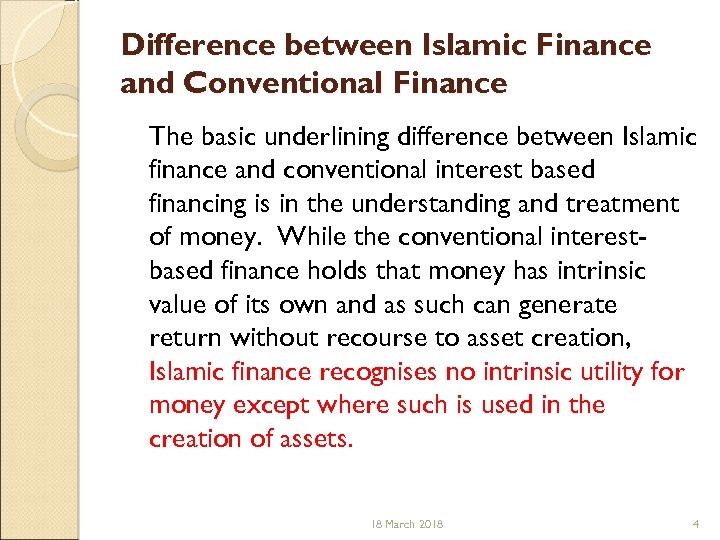

Legal instrument deed cheque is the Arabic name for financial certificates also commonly referred to as sharia compliant bondsSukuk are defined by the AAOIFI Accounting and Auditing Organization for Islamic Financial Institutions as securities of equal denomination representing individual. Difference Between Islamic Banking and Conventional Banking. The main difference between Islamic and conventional finance is the treatment of risk and how risk is shared.

Complying with prudential regulatory commitments. Note - the US recognized Jerusalem as Israels capital in December 2017 without taking a position on the specific boundaries of Israeli sovereignty geographic coordinates. The main difference between conventional finance and Islamic finance is that some of the practices and principles that are used in conventional finance are strictly prohibited under Sharia laws.

Interest in completely prohibited in Islamic banking. Taking rational action as a starting point but rejecting the. In contrast with this conventional economics has become a well-developed and sophisticated discipline after going through a long and rigorous process of development over more than a century.

Like conventional lenders microfinanciers must charge interest on loans and they institute specific repayment plans with payments due at. After 8 years the fsagovuk redirects will be switched off on 1 Oct 2021 as part of decommissioning. Islamic economic system Islamic political system and Islamic moral system.

Islamic banking is an Ethical Banking System and its practices are based on Islamic Shariah laws. UTC2 7 hours ahead of Washington DC during Standard Time. On May 30 2021 armed bandits abducted up to 150 students from an Islamic school in Niger State north central Nigeria.

Therefore it has its own economic system which is based on its philosophical views and is compatible with the.

Islamic Capital Markets Main Function Is To Facilitate Transfer Of Investable Funds From Those Having Surplus To Those Requiring Funds Achieved By Selling Ppt Download

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Islamic Financial Engineering Comparative Study Agreements In Islamic Capital Market In Malaysia And Indonesia Semantic Scholar

Islamic Financial Engineering Comparative Study Agreements In Islamic Capital Market In Malaysia And Indonesia Semantic Scholar

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

Chapter 2 Framework Of Islamic Financial System Ppt Video Online Download

The Growing Global Appeal Of Islamic Finance

Islamic Finance In The Nigerian Capital Market By

Islamic Accounting Practices The Importance Of Islamic Capital Mark

Islamic Financial Engineering Comparative Study Agreements In Islamic Capital Market In Malaysia And Indonesia Semantic Scholar

The Growing Global Appeal Of Islamic Finance

Islamic Liquidity Management The Malaysian Experience Seminar On

Pdf Islamic Capital Markets Developments And Issues

Overall Structure And Regulatory Framework Of Islamic Capital Market Ppt Download

Interdependence Between Islamic Capital Market And Money Market Evidence From Indonesia Sciencedirect

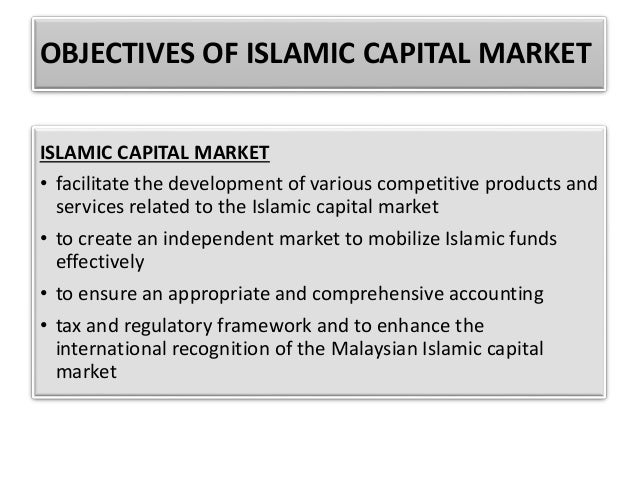

Islamic Capital Market Ppt Video Online Download

Islamic Accounting Practices The Importance Of Islamic Capital Mark